Discover the bucks in your auto! Score dollars timely! Zero credit check called for! The newest advertising to have vehicles name money generate credit facing the car seem like an effective foolproof option to your financial issues.

Not so punctual. Automobile title loans are generally a dangerous, high priced type of credit. Not only are rates of interest sky-high, but individuals who can not repay its obligations might have the vehicle repossessed. Yet , the individuals disadvantages have not averted the auto title financing industry out of surviving, for example of the targeting people who live to the financial boundary.

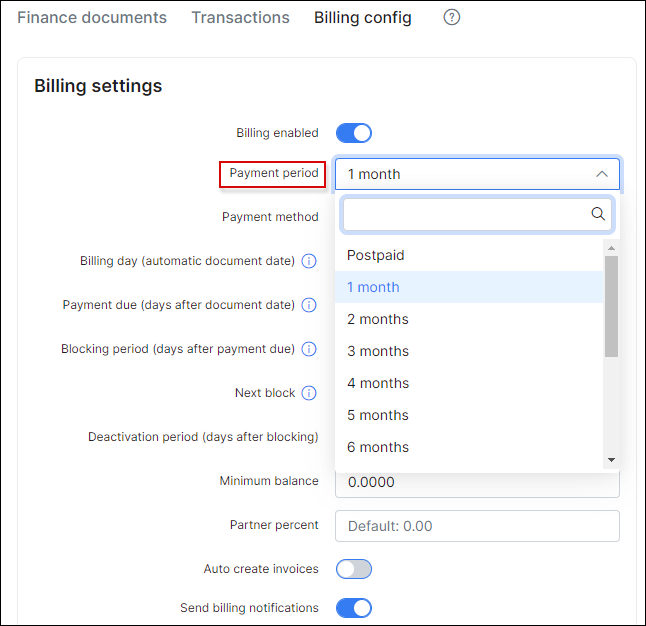

Here is how a title loan works: A lender requires the car’s identity as the collateral to own a short-term loan. Being qualified can be effortless you simply need to own the car outright. There are no borrowing otherwise income checks and you can end up being able to get money in moments. Once a short span (constantly 1 month), the full amount borrowed should be paid off, and additionally people fees. If you’re unable to improve percentage, the lender either requires the automobile or provides the danger in order to renew the mortgage, getting a supplementary fee.

Not surprisingly, label financing will ensnare more vulnerable users people that can’t borrow money through more traditional present. Advertising may well not certainly disclose interest rates or gamble up bonuses that make the fresh new funds have a look less expensive than they are really, according to Heart getting In charge Credit.

Given how aggressively he could be offered, title loan companies may also be drawing in people who you can expect to borrow funds during the a more affordable method. 50 % of some body surveyed by Pew Charity Trusts told you they’d get a loan out of a bank or credit connection whenever they decided not to rating a title mortgage and many mentioned that it selected a subject loan predicated on benefits, perhaps not affordability. One means that people might not realize how ruinous name finance will be until they have been currently caught up inside the a period regarding financial obligation.

1. They’ve been more widespread than ever

Title loans are very more prevalent as it is be more tough to own people so you’re able to borrow cash various other ways. Handmade cards try more complicated for some people to locate, household equity personal lines of credit enjoys dried out, and several states have tightened statutes to payday loans lenders. Auto identity loans are particularly a last-abandon monetary lifeline for most.

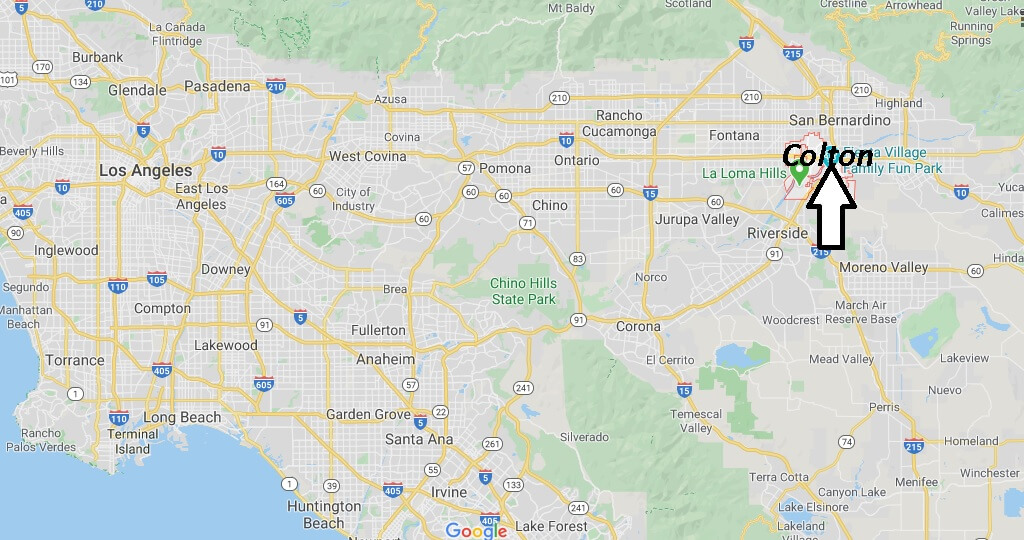

From inside the California, the amount of vehicle title money has actually increased significantly in the last few years, from 38,148 in 2011 to 91,505 inside the 2013 (the 12 months by which info is available), centered on a report from the Los angeles Minutes. All over the country, more than dos million some body pull out car term fund for every 12 months, with regards to the Pew Charitable Trusts.

dos. They’ve been badly controlled

Half of says ban automobile label funds outright. However in states that do enable these borrowing, regulations are shed. Triple-little finger rates with no caps toward mortgage restrictions commonly uncommon, for each a good 2012 report from the User Federation from The usa.

In some instances, court loopholes ensure it is title loan companies to survive. California, such as for example, features hats into the interest rates charged to have short funds, but there is however no roof to have finance over $2,five-hundred. Thus, of numerous loan providers require one borrowers sign up for money of at least $2,five-hundred, no matter if they want quicker, according to the Los angeles Minutes.

Already, the consumer Economic Cover Agency are considering the new laws and regulations on the auto label finance that https://paydayloancolorado.net/east-pleasant-view/ would want lenders to make certain that consumers can be pay their bills.

step 3. A was brilliant in the getting around laws

Though some lawmakers is getting a close look from the automobile label financing, reining in the business may be difficult. Whenever regulators purchased to compromise down on title fund from inside the going back, the provides battled straight back, often creating creative getting inside the laws who do are present.

Particular lenders erican tribal countries as a way to get around state and federal guidelines, according to a research about Heart for Western Improvements. After Wisconsin and you may The newest Hampshire introduced laws restricting term loans, the properly did to have her or him repealed. Within the Tx, specific metropolises passed restrictions to the vehicle label finance. Loan providers replied by offering free financing at specific locations. If it appeared time for you to replace the loan, the latest the businesses steered individuals on their branches within the locations with zero constraints towards the financing.

It’s a lure and you can button, Ann Baddour of one’s non-earnings Colorado Appleseed, informed Pacific Important. The newest behavior may possibly not be illegal, however it is needless to say shady and you may unconscionable.

4. The interest and you may charge was ridiculous

The average automobile identity financing was getting $step 1,one hundred thousand, with respect to the Pew Charity Trusts, additionally the typical Annual percentage rate towards a-one-day loan was 3 hundred%. It is far from unusual to possess a borrower to finish upwards spending way more inside the fees than just they amount they initially lent – typically $step one,two hundred a year.

Both, the fresh payments and you can fees are incredibly difficult that people merely bring up-and allow the lender take the vehicles.

I’m expenses … focus, and you will my prominent has not yet go lower a while. I shed an automible by doing this … We reduced in it for almost a year. This may be dawned on the me personally, and i finally told you, You are sure that, this is certainly ridiculous; bring so it dumb vehicle.’ told you one debtor questioned towards the Pew statement.

5. Of many consumers manages to lose its vehicles

About 11% of people otherwise 1 of nine just who borrow secured on their automobile in the course of time cure the car. With an auto repossessed can result in people’s economic issues to help you spiral next out of hand, particularly when without a car will make it tough or hopeless to arrive at functions. A third of people who play with term loans try solitary-vehicle households, depending on the Pew study. Complete, between 120,100000 and you will 220,000 people treat the trucks in order to title financing repossession from year to year.

I view term credit as legalized vehicles thievery, Rosemary Shahan, president of Customers for Vehicles Precision and Security, a sacramento, ca advocacy group, told the new Los angeles Times. What they need accomplish try allow you to get with the a loan in which you merely continue expenses, purchasing, investing, at the end of your day, they take your vehicles.

Realize Megan with the Fb Wanted far more high stuff like this? Register here for the very best of Cheat Piece brought everyday. No spam; only customized articles straight to the inbox.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια