Regardless if you are a skilled individual or a primary-date visitors, navigating the home loan application techniques will be daunting. Follow this self-help guide to create the primary financial application.

Owning a home try an aspiration for most Australians, and home financing is often the key to and come up with you to definitely fantasy a reality. But with a lot of loan providers and you may possibilities, the house application for the loan processes can appear daunting. This article have a tendency to walk you through the newest measures of making a great home loan software that’s strong and leaves you throughout the better status to locate acknowledged on mortgage you prefer.

First Financial Eligibility

If you aren’t a keen Australian resident otherwise permanent citizen, you must be during the a de- facto relationship or partnered in order to a keen Australian resident or permanent citizen.

Crucial Home loan Software Data files

More lenders iliarise your self with this so you’re able to customize the job consequently. This could encompass proving regular a job, a good credit score, or an effective deals record.

step one. Score Any Documents Sorted

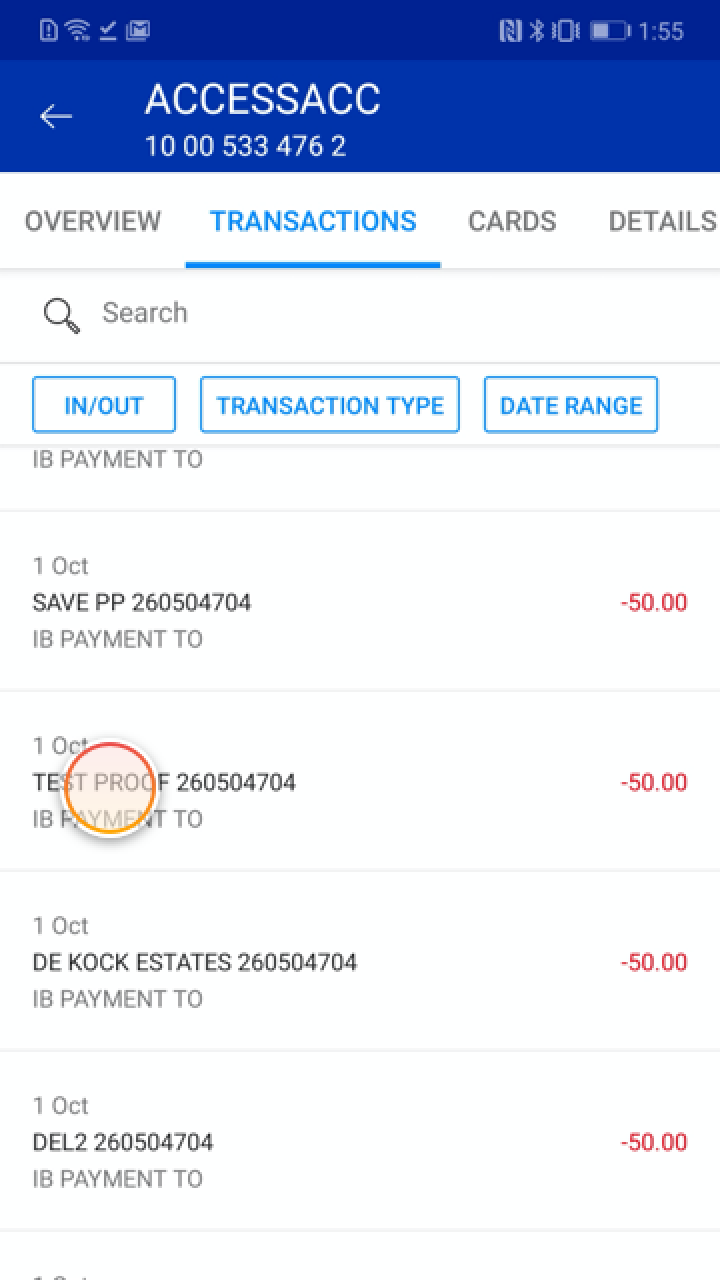

The first step of your property application for the loan was gathering all of the the desired files. This can include proof label, money, assets, and obligations. Getting your documents arranged in advance have a tendency to automate the procedure and relieve the chances of waits. Key data files include latest payslips, tax statements, lender comments, and you will a recent ID. Organising this type of data files will also leave you a sharper image of your financial situation.

dos. Pre-Qualify for Your loan

Pre-certification was a primary action where lender will bring an estimate of how much cash you could acquire. That is according to research by the information your provide about your income, debts, and you will property. You should note that pre-qualification isnt a promise away from loan acceptance, however it does make you a sense of their borrowing skill helping your target features affordable.

step 3. Rating Original Acceptance

After pre-being qualified, the next step is to find preliminary acceptance (labeled as pre-approval). In this phase, the financial institution performs a thorough post on your debts. First recognition shows that the lender would probably give you the currency, so long as specific requirements are satisfied.

4. Located Conditional Approval

Once your lender has analyzed the application, they might procedure conditional acceptance. It indicates your loan is approved the theory is that, but it is subject to certain conditions becoming fulfilled. These types of criteria commonly interact with the house you wish to pick and could is a reasonable valuation.

5. Lender Can do a security Assessment

The safety assessment was a life threatening area of the procedure. Right here, the lender evaluates the property you want to get to make sure it is a suitable shelter to your mortgage. So it always involves a property valuation to choose if for example the property’s worthy of aligns with your loan amount.

6. Rating Loan providers Financial Insurance coverage (LMI)

If your put Greensboro loans is actually less than 20% of the property’s worthy of, you’re expected to rating Lenders Home loan Insurance policies (LMI). LMI covers the lender in the event you default on the loan. It is vital to factor in the cost of LMI, as possible add a quite a bit into loan.

seven. Discover Last Approval

Finally acceptance is granted whenever the criteria of the conditional recognition was fulfilled, therefore the lender was happy with the security investigations and any almost every other criteria. Thus far, the financial institution tend to confirm that they are prepared to financing their property pick.

8. Loan Bring is actually Provided

Immediately after latest approval, the bank often situation an official mortgage provide. So it document outlines new terms and conditions of one’s loan, including interest rates, installment schedule, or any other important information. It is vital to feedback which provide carefully and ensure you realize all facets of one’s mortgage.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια