It will feel just like there is a lot knowing prior to taking away a mortgage. Where to go, what data needed plus the timeline could be several anything in your thoughts – particularly if you might be an initial-day homebuyer. But with particular planning, you will end up well on your way in order to navigating which section of this new homebuying travels.

Even though home loan software timelines will vary individual-to-people, any where from 2-3 weeks to some days, shopping around beforehand and you will collecting your write-ups is a means to assist start.

What’s a home loan?

Let us begin at the start: a mortgage try a security arrangement between a homebuyer and you may a great lender familiar with money property purchase. A prospective homebuyer normally applies for a financial loan during the a financial or any other leading lender by providing information regarding the money as well as the household they’ve been looking to purchase. The lending company upcoming assesses its certification and uses them to create the loan conditions. Loan words generally speaking through the method of and you may amount of financing, number financed, interest and other key facts. The mortgage is the document providing you with your bank a safety need for your home because the equity for the loan.

So what does the mortgage application procedure seem like?

- Prequalification

- Application, qualification, file planning

- Closure – Indication brand new dotted range!

Precisely what does it indicate so you can prequalify to possess a mortgage?

Prequalification ‘s the action you to definitely usually comes in advance of your official app and you will has got the home loan process started. It is essential to keep in mind that a good prequalification is not a definitive dictation out-of what someone’s home loan look particularly. If or not you prequalify on the internet or perhaps in person, you’ll likely feel wanted standard factual statements about your earnings, jobs, monthly bills and you will number available to possess a down payment. In exchange, the financial institution will provide you with a broad guess of your attract rate and you can mortgage conditions you can qualify for. Manufacturers have a tendency to wanted proof of a prequalification ahead of allowing the consumer to create a deal on the a home.

Financial application data files

Once expertise what sort of financial you may also be eligible for, selecting your new household and you can signing the acquisition contract – this new legitimately binding file one to sets your for the deal towards the an excellent domestic – it would be a great time to start the formal app. This is when you provide the lender on particular and detailed information about your earnings, our home you are looking to find as well as your downpayment – possibly on line or perhaps in people, depending on individual tastes and features your own lender brings. You need support records to ensure that which you, so you might need to prepare your home loan app data from inside the progress to assist expedite the applying process. Check out things you may want to has handy:

- Latest pay stub(s)

- W-dos otherwise 1099 variations

- Lender comments

- Finalized home buy offer, hence confirms your lower than deal to your home and you can able to move pass

- If you find yourself taking right out the loan having a great co-debtor, then you will probably you need duplicates of their records and you will trademark as better

The length of time really does a home loan application simply take?

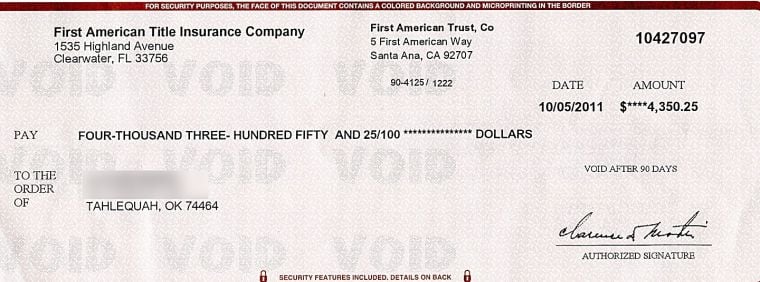

Completing the application usually takes any where from a couple of hours to a short while depending on how long it needs for your requirements to get and complete the mandatory data files, that is the reason a lot of people prepare all of them in advance. This new recognition may come instantaneously otherwise after a few months, therefore the underwriting process – whenever a loan provider drafts and operations the hard information on your mortgage – can take 2-3 weeks. When you secure the financial, it is up coming that one may proceed into the closure on the house.

Do numerous mortgage software damage my personal borrowing?

People will research rates examine financial cost off some other lenders. It is critical to know that when you make an application for a home loan, the financial institution tend to makes a hard query in your credit file, that gives the lender detail by detail usage of your credit score. These difficult inquiries have the potential so you can effect your borrowing get. Luckily for us that numerous loan-associated hard issues in a brief period of your energy typically merely trigger an individual “hit” towards the credit rating, since lenders discover users need shop costs. That it prospective reducing is short term and you may normally small, so users may suffer they are able to buy an educated package without having to worry their score usually tank.

Bottom line

Because it turns out, the loan app techniques isn’t that daunting out money to loan The Pinery of a method immediately after all the! By prequalifying and you may get together your posts ahead of time, you’ll end up on your journey to homeownership before you know it.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια