Key shows

Lenders home loan insurance policies (LMI) is generally needed for mortgages having a deposit out-of less than 20% of your own property’s well worth.

Articles insurance is not necessary getting a home loan, as it merely discusses property rather than this building in itself. Landlord’s insurance is generally used in financial support qualities.

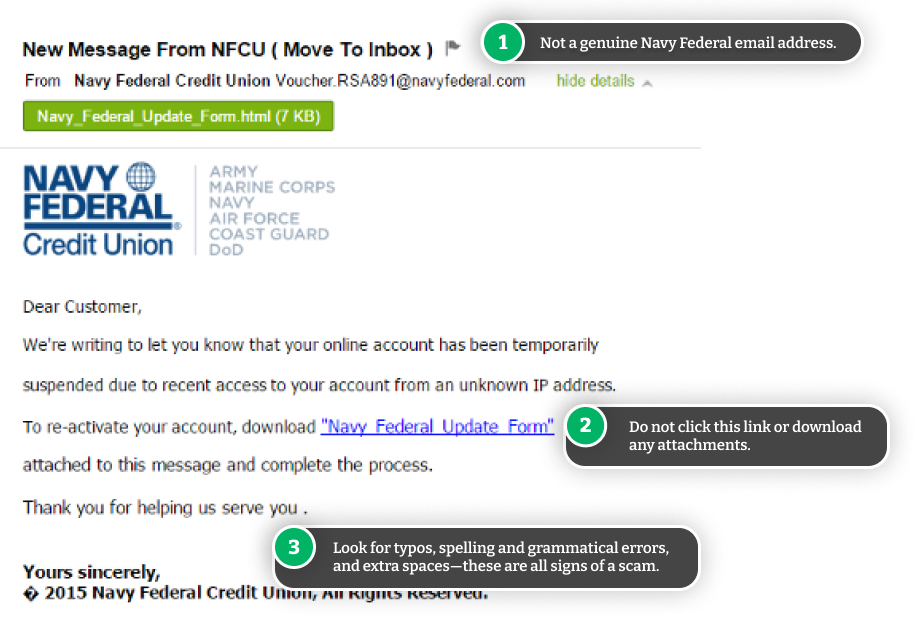

When you are homeowners insurance is not compulsory in australia, extremely mortgage brokers require consumers to have a home insurance policy in place more than a house just before might agree a home loan application.

You aren’t lawfully necessary to possess home insurance in australia, like the manner in which you you prefer a compulsory 3rd party (CTP) arrange for your car. While you are happy to use the risk, you can go without home insurance and steer clear of paying advanced. Without a doubt, if your worst were to occurs, you’d up coming have to protection the newest repair or rebuilding costs oneself.

not, of numerous Australian mortgage lenders wanted individuals to own a sum-covered otherwise full replacement for homeowners insurance policy set up as part of your eligibility criteria due to their lenders.

It is because home financing try secured by value of the house or property, a little while for example a protected auto loan. In the event your strengthening are busted otherwise lost from the a flame, flood, otherwise comparable crisis, together with borrower along with defaulted on the home loan, it’s unrealistic the lending company you’ll realistically get well their money by the repossessing and you may promoting the newest damaged otherwise shed property.

Which have a property insurance coverage in place ensures that even though a house was busted otherwise destroyed, the financial institution (plus the resident!) can be certain that it might be fixed or reconstructed so you can an identical practical, so the really worth is continue to secure the home loan.

You might normally sign up for home loan pre acceptance without needing insurance coverage. But when you’ve discover a property and had a deal approved, the financial institution might want one suggest to them you have an effective homeowners insurance policy in place in the payment big date to verify one last acceptance.

Accommodations, townhouses, houses, and you can comparable strata devices are managed in a different way in order to homes when it comes to home insurance and you will mortgage brokers. This is because this type of characteristics are often already covered of the strata firm. Whether your property is busted otherwise destroyed, it has to already end up being secured, very yet another home insurance plan shouldn’t be requisite.

Do you need Lender’s Financial Insurance rates (LMI)?

Loan providers mortgage insurance policies (LMI) is generally simply called for if you find yourself making an application for home financing with a deposit from less than 20% of the property’s worth. This will mean you will be credit over 80% of one’s property’s worthy of, improving the lender’s monetary chance if you decided to default on the your residence financing.

A keen LMI rules simply talks about the lender’s exposure, Maybe not brand new borrower’s, and more than loan providers pass the expense of LMI towards towards borrower to expend. Small your house loan put, the better the borrowed funds so you can Really worth Proportion (LVR) together with a great deal more you might have to buy LMI.

Before you apply to possess a home loan having a low put, it may be really worth quoting the possibility cost of LMI to help you get a good idea of in case the home loan are nevertheless worthwhile.

If you do require an insurance policy that covers your if the you are incapable of pay for the mortgage payments, you could potentially thought comparing money shelter insurance quotes.

Do you want articles insurance?

Articles insurance policy is not essential to take out a home loan, whilst only discusses problems for the fresh property stored in a good home, and never the building itself, that’s where in actuality the home loan lender’s attract lies.

Manager occupiers is able to make an application for a blended house and you can information insurance coverage, which may are cheaper overall than simply a couple independent principles.

Do you need landlord’s insurance?

Taking a mortgage into https://paydayloanalabama.com/falkville/ an investment property may require you to definitely take out a property insurance to greatly help safeguards the risk in case your home is damaged or lost, same as with manager-occupier home loans. Particular insurers bring specialized property manager insurance, that are prepared with financing properties in mind.

No matter if you are to shop for a good strata equipment as your investment property, it can be worthwhile considering an excellent landlords insurance. If you’re injury to the fresh new unit’s design because of natural disasters and you can such like will be currently end up being included in the fresh new strata’s insurance rates, landlord insurance policies years for the reason that clients.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια