We make the worry out from the mortgage research process to have the customers to really make it better to get the best family financing within the Quarterly report. With over forty lenders and you may 100’s of products available, selecting the right manager filled otherwise resource mortgage is generated easy with your app you to connects right to the banks.

Discussing the objectives of the financial situation both for the fresh short and you may longterm, enables us to acquire a definite image of your needs to help you beat fees and you will charges and you can loan providers home loan insurance coverage (LMI) will cost you.

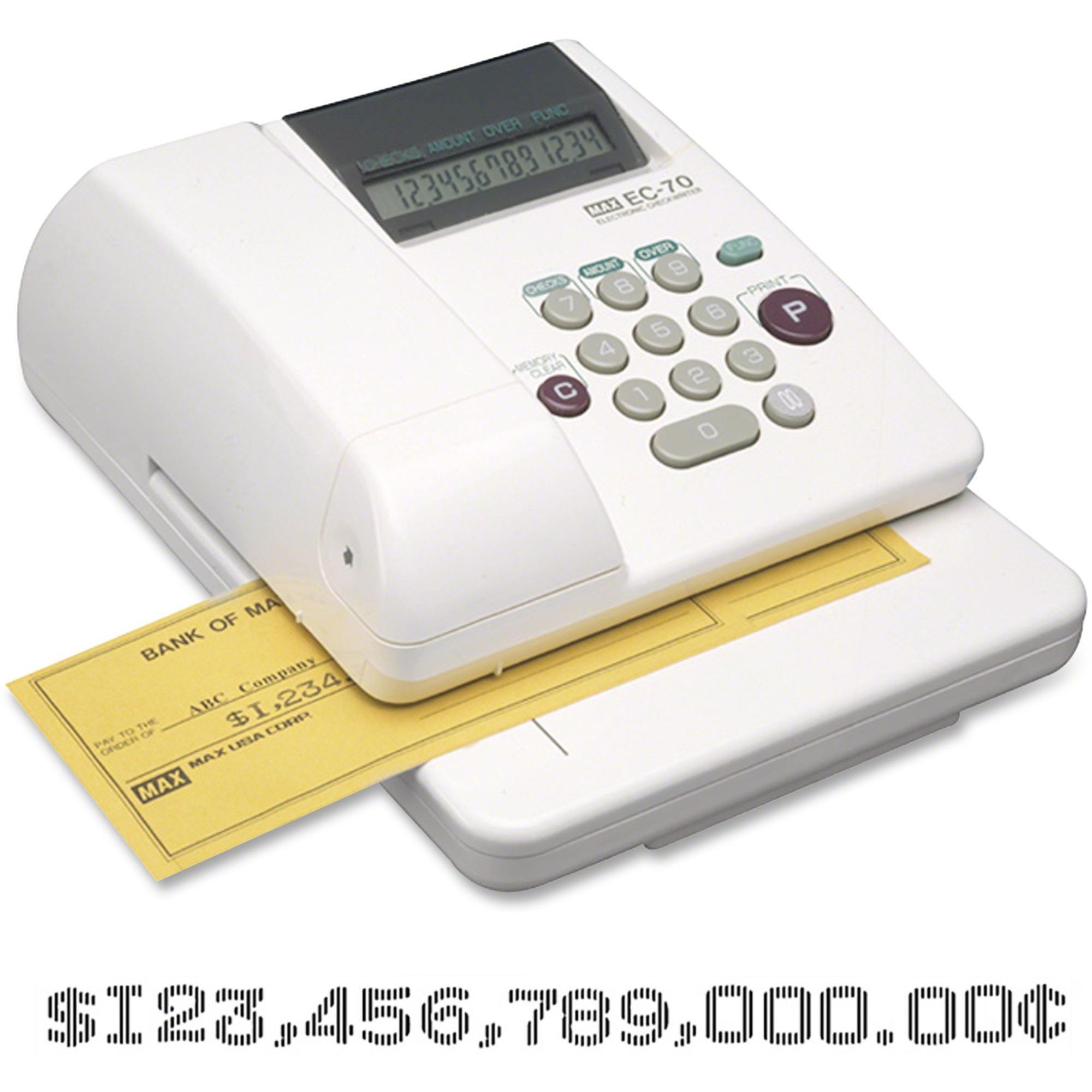

Within the free services, we will present an entire home loan analysis for the Quarterly report discussing a knowledgeable home loan pricing and you may investigations prices. We can and additionally specify their actual costs using a cost calculator and take into account any extra costs and you may latest loan amount in the event the using an offset membership.

Whenever evaluating the borrowing capability and you will amount borrowed, we’ll identify how lender calculates your capability to settle the borrowed funds if you choose to pertain, and when called for, indicates how handmade cards as well as their restrictions increases otherwise drop off their borrowing from the bank skill.

Ideal financial cost

It’s not hard to believe that a knowledgeable home loan rates are definitely the ones towards lowest rate of interest, but that’s not necessarily your situation. In some instances, an amazingly low interest come with charge and you can charge and you will financial restrictions which make the item a great deal more expensiveparison costs let you know the true interest rate however, often individuals was claimed more by the latest advertised rate of interest and don’t reason behind others aspects one enhance the loan payments. Specific loan providers create margin to their cost by the monthly costs and you may costs, charge for extra money, offset accounts and redraw establishment. You can expect the full unit analysis with the undetectable fees and charges so you’re able to compare home loans from inside the Sydney precisely.

To buy For the Questionnaire

The fresh Questionnaire possessions field has evolved somewhat over the past a few ages, particularly in aspects of this new Quarterly report CBD, brand new Northern Coastline, West Suburbs and you will Northern Suburbs. Getting into the fresh Quarterly report property field shall be problematic however, truth be told there are nevertheless solutions throughout the external suburbs regarding Quarterly report. People is always to stop suburbs where there was a glut off accommodations since the loan providers consider these to be highest-risk, like because of the larger cuatro finance companies. High-chance suburbs may need deposits as much as 30% out of individuals, making it important to consult a sydney large financial company just before starting your home look. Considering Sydney’s higher assets thinking, getting the lower loan payments and you can plus new features for example a keen offset membership otherwise redraw business are essential to make sure your reduce charges and charge also, reduce the borrowed funds as quickly as possible.

Home loan CALCULATOR

Perhaps one of the most perplexing parts of securing home financing try working out how much cash you could potentially obtain and you will just what financing costs could be. This is why a common on the web financial calculator will provide homebuyers wrong numbers and exactly why dealing with an independent mortgage representative in the Questionnaire is paramount to providing accurate information. When figuring your credit potential and you may mortgage payments, we make sure you have the capacity to pay the mortgage and you don’t offer your own borrowings outside of the finances.

Home loan Tool Comparison

Once you learn just how much americash loans Montevallo you could potentially obtain, the next step is to compare home loans to find the best home loan cost. Which have entry to more than forty additional loan providers and you can 100’s of different home loans, Mint Equity’s system brings data directly from the lenders to ensure we become the newest financial services comparison prices to possess you to decide on regarding.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια