HELOCs can be used http://cashadvancecompass.com/personal-loans-pa/hudson for too many grounds and therefore are high creative answers to we seeking approaches to trying to find currency to enhance its profile from inside the a property. If you were to for a lengthy period you are sure that you to definitely while the your venture out into the capital markets your often will require initial currency to close off the loan. HELOCs are good a way to obtain out of your newest first possessions to locate you to required downpayment for another possessions. Are you aware that the loan providers at ADPI also have good NOO HELOC? Just a couple of months before I affirmed when you find yourself speaking with the in house financial that individuals now offer low proprietor occupied HELOCs. That said think one of the earlier requests a beneficial 2 years ago that will enjoys a little bit of equity is a potential so you’re able to acquire from!

In order i dive into the details of a great HELOC they is important to understand that only credit the money and you may carrying it may not be the best financial support. Rather we remind people to has actually an idea on which they will probably do with this dollars! Why don’t we enjoy from inside the and watch in the event it product is a thing that can help you with your next pick otherwise a venture your are presently onto fix enhance first if you don’t a different sort of excursion

What is a home Collateral Line of credit (HELOC)

A property equity personal line of credit otherwise HELOC to possess short, performs particularly a credit card where the debtor possess a credit restrict, but alternatively of using cash, they normally use brand new guarantee in their house while the guarantee. HELOCs also are also known as the next financial. HELOCs have a variable rate of interest and are also generally speaking used in big expenses instance renovations, training, or medical expenses. The newest borrower normally withdraw money as needed and only will pay attention towards amount borrowed. Installment terms are very different however, usually cover a blow period when the new borrower can be withdraw fund, with a fees months during which the brand new borrower must generate monthly premiums to spend right back the loan.

What is actually House Collateral Financing

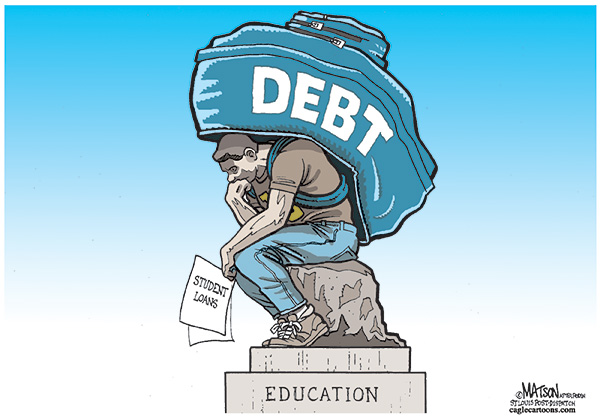

Home security finance are a type of financing enabling homeowners to borrow funds by using the equity in their house due to the fact guarantee. Household equity fund also are felt a moment financial. The borrowed funds count is generally according to the difference between the home’s ount owed towards home loan. Home collateral finance keeps repaired rates and are made use of to have biggest expenditures/debt paydown such as for instance home home improvements, personal loans, or training. The loan try paid back over a flat time frame with fixed monthly premiums. If your borrower cannot make the payments, the lending company may foreclose into the household that was put as the equity. A mortgage are certain to get a lower interest than a property guarantee mortgage, as home financing retains the first consideration towards the payment regarding the experience away from not paying the newest money that will be a reduced risk towards the financial than simply property collateral mortgage. Home guarantee fund will vary from property collateral line of borrowing from the bank, that allows to get more independence inside credit and you will payment.

HELOC Stages

- Draw Period: When you look at the mark months, and therefore normally continues 5 to 2 decades, brand new debtor can withdraw money from the financing fall into line to the maximum amount enjoy. The latest debtor simply pays the speed on loan amount and certainly will desire make repayments for the prominent if wished. If mark months finishes the fresh new HELOC actions towards fees period.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια