Protecting a mortgage is a big milestone in lot of man’s lifestyle, giving besides money and in addition paving the way in which toward possessing a piece of a house. Within context, teaching themselves to carry out and feedback your home financing will get paramount. This new ICICI Bank Home loan Statement try a vital file in it travel, providing a thorough report on the loan facts, fees history, and you may left equilibrium. They serves as a financial ledger for your house mortgage, documenting all the purchase between both you and the financial institution about your mortgage.

Being able to access and you may evaluating their ICICI Lender Mortgage Declaration sporadically is important for productive mortgage administration. It permits you to song your fees progress, identify any discrepancies early, and implies that you are always aware of debt commitments. This informative guide aims to demystify the procedure of getting their ICICI Mortgage Report, it is therefore accessible and you may quick for each and every citizen. Whether you are technical-experienced or choose old-fashioned tips, this guide talks about every step to ensure you have access to their loan declaration effortlessly.

Understanding the ICICI Financial Statement

- Suggestions of debtor and you will financial account

- Current the mortgage count

- Applicable mortgage interest (fixed/floating)

- Amount of each EMI repaid

- Writeup on dominant and you can focus count in the monetary 12 months

- Specifics of part payment (if any)

- Financial number paid right until go out.

Pros and you can Uses of ICICI Bank Financial Report

This new statement isn’t just track of transactions; its a vital document getting financial believed and you can mortgage management. It helps you know how much of the loan try repaid off and exactly how much has been due, allowing you to bundle your money most readily useful.

Clarifying advance cash loans online New Jersey The loan Position and you will Economic Think

There are many different stuff you must look into before investing in real estate such Preciselywhat are better upwards fund? What’s Smart Control in A property? Precisely what does step one RK household means?

One particular main point here that always should be reviewed was our home mortgage declaration. Daily evaluating your ICICI Financial Declaration can be somewhat impression their monetary planning. They describes the loan position, exhibiting the borrowed funds repayment advances. This information is crucial for making plans for your earnings, because it makes it possible to determine how far currency you can allocate with other expenditures or offers. In addition, it implies that you are on song with your loan money, to prevent people shocks later on.

ICICI Mortgage Focus Certification: A vital Device getting Income tax Protecting

Brand new ICICI Financial Focus Certification is an additional crucial file to own residents. They info the interest part of your loan money over the economic seasons, that is essential claiming tax deductions around Part 24 regarding money Income tax Act.

How-to Influence Your loan to possess Taxation Advantages

Income tax experts show one of the advantages of financial. Learning how to control these types of experts is paramount to boosting their coupons while you are paying your loan. Utilizing the ICICI Financial Attract Certification, you can effectively lower your taxable money by the stating write-offs on the the interest repaid on the financial. Which besides assists with protecting taxation also inside handling your finances more efficiently.

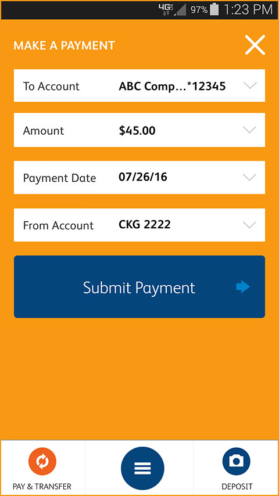

Releasing the whole process of ICICI Bank Financial Report Download

To begin downloading your own ICICI Home loan Report, always have your financial info helpful. This first step is straightforward however, crucial for being able to access your loan statement quickly and you may safely.

Of these exploring selection along with other banks, learning how to down load the latest HDFC Home loan On line Statement can promote information towards processes.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια