An effective 550 credit history is not a beneficial. It is experienced poor. You will have difficulty being qualified the version of mortgage that really needs a credit assessment. If you are recognized to possess a free account, be prepared to score a higher rate of interest than simply you would like.

No, 550 isnt a good credit score to own home financing. Its an awful rating. That it desk shows that FICO will not bring a credit score interest rates for credit ratings less than 620.

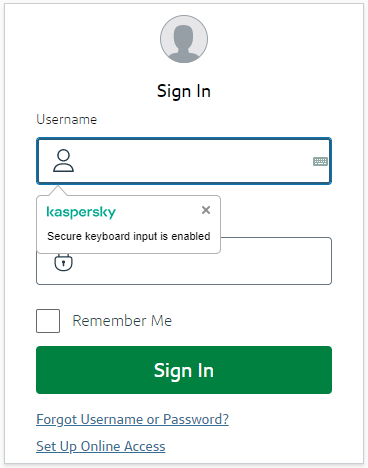

Mortgage Pricing by the Credit score

Getting a home loan, a keen FHA financial is the best alternative for consumers that have good credit score from 550 or maybe more. A national Homes Management (FHA) lender may take money which have credit ratings as little as 500 if one makes a down-payment of at least 10%.

A credit history out-of 580 or more becomes necessary for you discover a loan if you can’t be able to set-out 10%. But if you put out some effort, you might be capable achieve that mark in a number of months.

When you have a poor credit score along with your lending company decides to undertake the application, you’ll most likely get the highest possible interest rate. As mortgages need including high off money, it is preferable to help you delay the application up to the borrowing improves.

Is 550 a good credit score to have an auto loan?

Having an auto loan, a credit rating away from 600 or lower than is not sensed higher level. A beneficial 550 credit rating enables you to see a car loan, however the interest rate will be sky-higher.

Auto loan overall personal debt is lower than that from family fund although the restrict rates of interest are numerous times big.

Consequently, if your credit history was terrible, you are investing large-rates of interest on the car finance. The new graph less than shows typical vehicles financing prices predicated on borrowing from the bank scores:

Mediocre Car loans interest rates By Credit Assortment

As the revealed regarding chart a lot more than, discover a serious difference in the greatest and you can lowest you are able to desire cost towards the vehicle loans.

You do not be able to delay your importance of a beneficial car, but recall new costs linked with awful borrowing just before investment your next car get. It would be beneficial if you possibly could invest time for you enhancing your credit history before submission a software.

Is actually 550 a good credit score getting credit cards?

550 is actually a dismal credit rating getting credit cards. The top credit card issuers usually refute the software. You can easily simply be recognized to have small amounts with a high costs and you will unfavorable rates of interest. Luckily, there are several less than perfect credit credit cards that may think about your software.

A credit history out of 550 try much easier to obtain an effective bank card than it is together with other kinds of financial obligation. You might not be able to get top credit card levels, but at least you are able to get one or two credit levels.

Another option is with getting a guaranteed mastercard. You’ll want to set-out an earnings put just like the security, that can easily http://www.elitecashadvance.com/payday-loans-ar/jacksonville/ be equivalent to the financing limitation with the credit.

How-to Boost a 550 Credit score

The good news is, there is a remedy when you yourself have bad credit. You may also constantly improve your borrowing from the bank for individuals who implement yourself, make the energy, and exercise a wise practice. If you would like guidance obtaining become, look at the pointers less than.

Have fun with The Borrowing from the bank Strengthening Acknowledged Companies

It could be simpler for folks who enroll the assistance of our very own top borrowing-building suppliers. Allow me to share properties we feel you really need to start by:

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια