Fl investor ed for confidentiality causes, was way of life proof: The guy never generated more than $52,000 per year away from police salaries. But not, he been able to generate a 25-device a home collection within just 5 years and you can retired early from the decades fifty. Insiders verified his assets ownership.

He uses many methods to increase the dollars necessary in order to level, from taking right out a good 401(k) financing to using a self-led IRA.

To invest in his first money spent-a beneficial $one hundred,100000 solitary-family home during the Virginia’s Shenandoah Valley-he grabbed out a home Equity Credit line (HELOC).

He rates he had regarding the $twenty-five,100000 from inside the deals when he purchased the house or property back to 2017. Although not, the guy doesn’t want to utilize all of the his discounts to cover the new down payment and you can transaction charge, that’s in which HELOCs need to be considered.

Inside the $31,one hundred thousand HELOC, Draw used from the $17,100000 of his full limit to have a deposit on the property while the coupons he currently got easily accessible to fund other upfront will set you back.

Draw was well-organized to find a property guarantee credit line when he provides paid his priily family he and his wife bought when he and his awesome wife moved to Virginia in the 1998 immediately following their Navy career ended. It paid back its mortgage early in 2015.

If someone else is within the exact same problem because myself, its first home is paid back, the life is cheap in addition they just need a little help, using an excellent HELOC can be a great way to score a good couple of dollars at the a competitive speed, Draw informed Insider. Usually, its less expensive than financial prices.

Usually do not confuse a HELOC with a house equity loan, gives your a lump sum at the start

It truly does work such as for instance a credit card you get a credit line as possible acquire more than a period of time (usually 5 so you’re able to ten years) titled a great drawdown months but the money your borrow arises from your house collateral . You don’t need to to utilize a good HELOC shortly after opening they. You are able to what you want when it’s needed. You can even open one and not put it to use.

Just how HELOCs really works

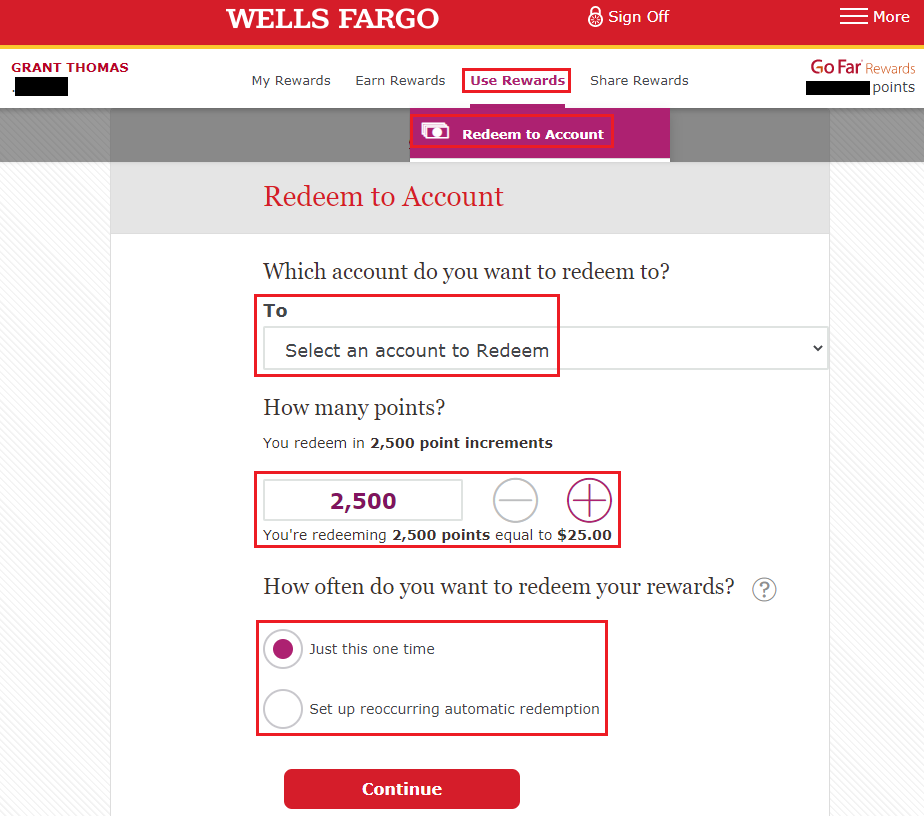

Inside sweepstakes, you can usually withdraw cash in several various methods: credit cards associated with your account, installment loan Sacramento dollars withdrawal otherwise on the internet account transfer. When you initiate withdrawing, might are obligated to pay the absolute minimum payment, that’s constantly only notice billed into the detachment period, but you can also pay back the main should you desire.

The borrowing limit can differ by the bank, but the majority HELOC lenders allows you to use to 85% of your own residence’s well worth (minus your debts). You don’t need to assembled that much, in the event.

For example, Mark wants a moderate HELOC. Their home is actually fully reduced and you may was value on $200,one hundred thousand at that time, definition he might have taken aside on the $170,100000, but alternatively joined so you’re able to borrow $30,one hundred thousand – or just around 15% out-of his house’s well worth.

Observe that HELOC lenders basically require that you possess a premier credit score (about 620, sometimes greater than 700). You need to also provide household security, so that you owe below this new home’s appraised worthy of. Loan providers may also look at your earnings and financial obligation and need a personal debt-to-income proportion off forty% otherwise less.

A good HELOC was a cards account where you could use once the many times as you need, around a certain restriction, best for if you find yourself unsure exactly how much you need to use.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια