- Be sure to have your army ID and you will proof of solution able. Your own social coverage number and permanent address are also called for.

- Bringing several contact where you could feel called is important to help you ensure that the financial you’re taking out of the loan out of has in contact with you, regardless of where youre stationed (age.grams., your loved ones home, their armed forces legs).

- Obtain a copy of credit history that one can bring toward financial institution, when needed. Of many loan providers do that on your behalf.

- If you cannot indication your loan documents in person, make sure to designate an electricity out-of attorneys in order to an individual who can exercise in your stead. Notarization may be needed in some claims.

Certain requirements for Financing Recognition?

If you like a car loan, don’t simply roam with the a car dealership. Are prepared and creating search ahead of time is paramount to obtaining a minimal-focus mortgage.

cashadvancecompass.com/personal-loans-or/ontario/

A different sort of car finance software will demand you to definitely fill out certain files to prove your income and personal suggestions, one of additional factors. Here are the data you ought to submit to own an automible financing.

1. Money Proof

Lenders generally speaking wanted proof of money to make certain individuals helps make their vehicle payments. To meet up with that it requirement, provide a cover stub less than you to definitely-month-dated demonstrating the 12 months-to-time earnings.

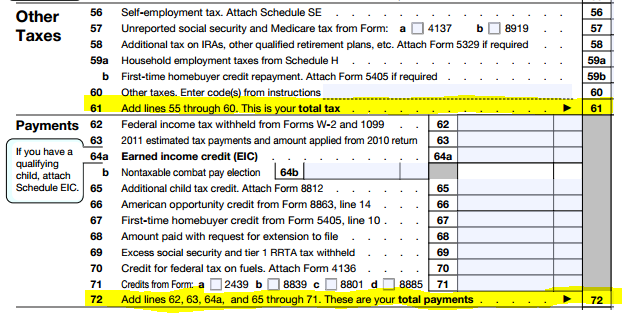

Tax returns and you can lender comments are required to own self-employed individuals. Really loan providers want 2 yrs regarding tax background, but they will get inquire about four. You will additionally you desire bank comments for the past three months.

dos. Residence Proof

The lending company must verify your target for the car loan application. There are lots of options available for your requirements to show you real time within address youre already using, such as a utility expenses or any other interaction you receive at your most recent address. A legitimate license is also needed if you plan to drive aside with a vehicle.

3. Insurance policies Facts

Legislation stipulates that all trucks while on the move should be covered, which means that your bank have to verify that you have got adequate exposure in advance of granting the application. Select your own insurance policies ID notes otherwise insurance coverage declaration pages and you may give all of them with that this new provider.

You might be capable secure insurance coverage in the dealership when the there is no need it currently, even in the event. Although not, for many who funds using a distributor, you will not have the ability to comparison shop to find the best cost. For those who have a good relationship with your financial, you might find a much better auto loan speed which have good preapproval car finance than just through the supplier.

4. Character

Evidence of the name is needed to receive an auto loan. First off the applying, you will want an image ID with your trademark, a recently available household bill impact the same address since your ID, as well as 2 months out of lender comments. Passports, government-given cards like Medicare identity notes, inventory licenses, and you can titles so you’re able to belongings and other car is acceptable types of character as well.

5. Monetary and you can Credit rating

And your existing and prior economic issues, lenders usually consider carefully your personal debt-to-money ratio (new percentage of their gross monthly income one to happens into investing your debts) along with your credit history and you can background.

With your basic personal information and you may agree, the lending company can access this article instead your being forced to offer one thing. But not, you ought to know that the lender usually test thoroughly your most recent and you can earlier credit rating.

six. Facts about the vehicle

When you sign up for an effective used-car loan, you’ll have to offer numerous factual statements about this new automobile you wish to get. The financial institution need to comprehend the vehicle’s purchase price, identification matter, year, make, design, mileage, fresh term and you may people liens on the car.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια