Delivering a home loan within the India is fairly effortless it are going to be a pricey affair. But not, there can be a silver liner to it, that is various taxation professionals you can rating all of the seasons on it, as per the specifications of the Tax Work, out-of 1961. So it Work consists of various areas around which more financial income tax experts was provisioned having financial consumers so you’re able to avail.

A property mortgage have one or two facets: payment of your own principal contribution plus the focus payments. Fortunately, both of these qualify for income tax write-offs. While dominant repayment are allowable not as much as Point 80C, deduction towards the appeal percentage are greet below Point 24(b) of the Taxation Work, 1961. Keep reading understand how-to avail of the interest towards construction mortgage deduction for ay 2023-24.

Taxation Masters toward Lenders

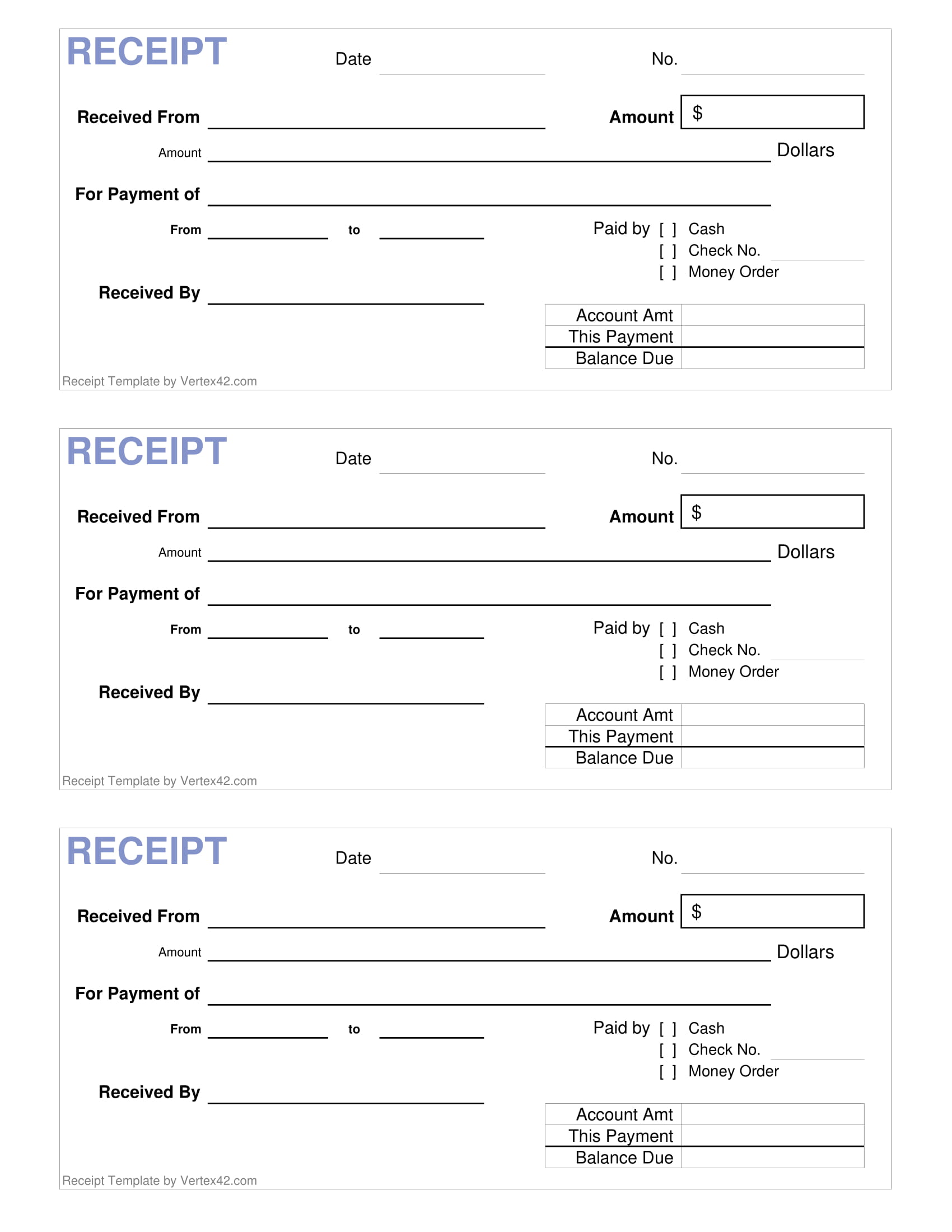

Another desk suggests the brand new annual tax masters beneath the different areas of the funds Income tax Act, off 1961, showing the house financing desire income tax deduction and you may casing mortgage focus difference.

So it financing have to be approved (birth 01.4.2016 and you can conclude 30.step 3.2017). The loan count are less than otherwise equivalent to ?35 lakh and the value of possessions doesn’t surpass Rs. ?50 lakh.

Point 80C: Tax Professionals towards Payment of the home Loan Prominent Count

Home financing borrower try permitted to claim income tax pros up in order to ?step one,50,000 on prominent payment of his/their unique nonexempt income, on a yearly basis. That it benefit are going to be said for both local rental and mind-occupied functions.

- So you’re able to allege work with significantly less than it part, the house or property which the borrowed funds might have been lent will be fully oriented.

- Extra income tax advantage of ?step 1,50,000 is also claimed below this point to have stamp responsibility and you may subscription charges; but not, it could be claimed only when, i.elizabeth., during these expenses obtain.

- An effective deduction claim cannot be generated in case the exact same house is marketed inside 5 years away from fingers.

- In such a case, one reported deduction will be corrected in the year off profit. Simultaneously, that it sum was included in the individuals money toward season, where the property is marketed.

https://paydayloansconnecticut.com/old-greenwich/

Not as much as Point 24(b), a beneficial taxpayer is allege a deduction to the attention paid down into the house mortgage. In this instance,

- One can possibly allege an effective deduction on the desire paid off towards house financing to possess a personal-occupied house. The most tax deduction enjoy is up to doing ?2,00,000 throughout the gross yearly money.

- In case men possesses several property, then in this case, the fresh new joint income tax allege deduction getting mortgage brokers don’t go beyond ?dos,00,000 in the an economic seasons.

- Whether your home could have been rented out, then there is zero restrict how much you can claim into the notice paid back. This consists of the whole level of attention paid back for the house financing into purchase, construction/reconstruction, and you will renewal otherwise repair.

- In case there is losings, it’s possible to claim an effective deduction of just ?2,00,000 inside a monetary 12 months, as the rest of the claim would be transmitted forward getting a period regarding eight age.

Around Point 24(b), an individual may and claim an excellent deduction into rate of interest in case the possessions bought is under design, while the framework is done. This area of the Act lets states for the each other pre-design and you will blog post-construction period focus.

Area 80EE: Even more Write-offs with the Attract

- So it deduction will likely be stated on condition that the expense of the family obtained will not exceed ?fifty lakh plus the loan amount is perfectly up to ?thirty five lacs.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια