SoFi (brief for Public Finance) are a leader in the wonderful world of technology-depending mortgages. SoFi basically works closely with high-money individuals having non-traditional forms of borrowing. In particular, they provide unique possibilities and you can masters for financial consumers.

Whether you are seeking a classic fixed-price financial otherwise a changeable-price financing, SoFi has plenty out-of choices for you to select out of.

Within this SoFi Financial remark, we shall go over the types of home loans SoFi has the benefit of, what must be done so you’re able to qualify, and also the benefits that come also choosing which mortgage lender.

SoFi Home loan App Conditions

In terms of making an application for a home loan, SoFi is kind of a mixed bag. This is because they have rigid credit history standards in a few elements, and generally are really lax in other people. Like, getting antique fund otherwise Arm mortgage loans, the minimum credit score is actually 660. For jumbo funds, the minimum credit history is 720.

All the SoFi debtor is required to put down a down payment with a minimum of 10%. And because their mortgages is actually set aside having large-money consumers, the minimum amount borrowed is $one hundred,100000.

However, SoFi is flexible with regards to obligations-to-earnings ratios. Including, borrowers that have significant education loan debt will still be entitled to pertain having a mortgage by way of SoFi.

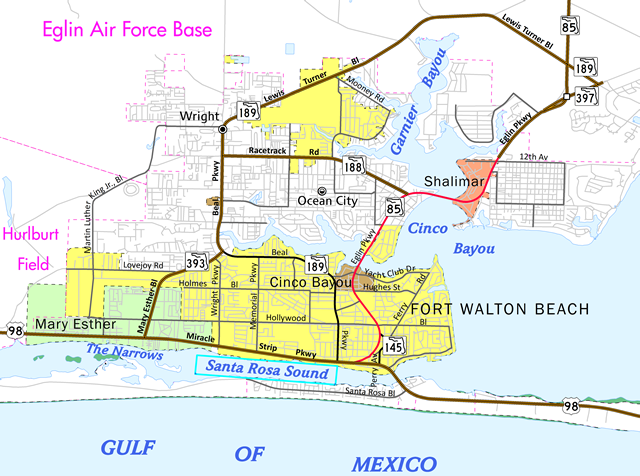

SoFi is a wonderful selection for individuals that meet the conditions, but they aren’t payday loan Enterprise available everywhere. SoFi is just registered so you can originate mortgages about after the claims:

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Ohio, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Montana, Nebraska, Nevada, New jersey, New york, Northern Dakota, Kansas, Oklahoma, Oregon, Pennsylvania, Rhode Island, Sc, Tennessee, Texas, Utah, North carolina, Virginia, Washington, Arizona, D.C., Wisconsin, and you will Wyoming.

Form of Lenders Readily available

Another thing that makes SoFi unique is that they try not to promote one authorities finance. That implies you can not submit an application for regulators-recognized finance particularly Va fund, FHA money, otherwise USDA funds because of SoFi.

However, they are doing bring many some other financing sizes. Here you will find the different varieties of mortgage loans you can submit an application for due to SoFi.

30-12 months Repaired-Rates Mortgage

This can be a simple mortgage equipment supplied by really mortgage brokers. The main benefit of it mortgage is that since your rate of interest is fixed, your repayments will remain stable over the life of the mortgage. This may almost function as cheapest arrange for very individuals.

The minimum down payment called for are ten% and there’s no personal mortgage insurance policies (PMI) required. Concurrently, you can visit up-to-go out mortgage rates on their website. It’s a greatest option that gives stability also give-away repayments.

20-Seasons Fixed-Rate Financial

Including the simple 31-12 months financial, good 20-12 months mortgage is determined at the a predetermined rates. This means your payments wouldn’t change-over the life span of mortgage. It’s a good idea having borrowers who wish to spend their financial out-of a small in the course of time and you can spend less on attention but aren’t happy to invest in good fifteen-season home loan.

15-seasons Fixed-Speed Financial

That have a good fifteen-season home loan, your monthly payment will stay an identical since your interest does not change. The major differences is that you could rescue loads of cash on notice as much as possible perform the higher money.

That is because interest rates usually are smaller having an excellent 15-year home loan. Together with, you might be settling the mortgage more than a shorter time frame, so the attention has actually a shorter time to build up.

However, because of that faster window to own repayment, the monthly premiums would-be high as compared to a thirty-12 months mortgage. However, if it is a workable number, it’s well worth contrasting your options to find out simply how much you can easily save when you look at the notice.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια