Rebecca Betterton is the automobile financing journalist to have Bankrate. She focuses primarily on assisting customers in the navigating this new ins and outs out of safely credit money buying an automible.

Advertiser Revelation

We are another, advertising-supported assessment provider. The mission should be to help you create wiser monetary choices because of the that gives interactive tools and you will financial calculators, publishing brand-new and goal articles, of the allowing you to perform browse and you will evaluate information free-of-charge – in order to create economic conclusion confidently. Bankrate provides partnerships having issuers as well as, but not restricted to, American Express, Bank away from America, Investment One, Pursue, Citi to see.

Exactly how we Make money.

The newest also offers that seem on this web site come from firms that compensate us. That it payment will get impression how and you can where points show up on so it site, along with, such as, the transaction in which they might appear inside the number groups. However, that it payment does not influence all the information we publish, or even the product reviews which you get a hold of on this website. We really do not through the market of enterprises otherwise financial now offers which are often out there.

Editorial revelation:

The product reviews are ready by the Bankrate team. Opinions indicated therein was only those of your customer and also not already been assessed or approved by people marketer. All the info, together with pricing and you can charge, showed regarding feedback is actually precise since the new date from the new remark. Browse the analysis on top of this site while the lender’s web site for most recent pointers.

At a glance

- Availability

From the Navy Federal

- Type of title lengths. Navy Federal has the benefit of over four installment conditions, with terms of as much as 96 months. It wealth implies that you can favor a repayment choice that meets your finances and requires, having a max that is higher than simply that competitors.

- Lower Apr. If you’re looking to shop for a different sort of auto or re-finance your existing car finance, you may be eligible for an apr only step 1.79 percent. This might be rather lower than the minimum Apr many most other lenders.

- Car To get Services. Due to TrueCar, Navy Federal’s Vehicle To find Solution allows you to examine MSRPs, located rates also provides into the regional inventory plus have your automobile taken to your.

- Subscription necessary. Auto loans are available in order to people who be eligible for Navy Federal subscription: energetic obligation services members, instantaneous family, pros and you may Service out of Safeguards team. To be a person in Navy Government, you should and additionally look after an effective Navy Federal savings account which have in the least a great $5 harmony.

- Restrict APRs perhaps not uncovered. Though Navy Government possess most reasonable carrying out APRs, it does not list their maximum rates. When you yourself have bad credit, it’s possible one Navy Federal installment loans Reno Nevada may possibly not be the lowest priced solution.

- Restrictions to own more mature put vehicles. When you find yourself used car with 2020, 2021 and you will 2022 design years be eligible for rates as low as 2.19 percent, one car over the age of you to definitely otherwise any car with more than 31,000 miles enjoys carrying out pricing away from step three.79 percent.

Who is Navy Federal ideal for?

A car loan with Navy Federal could be the best option to own army players as well as their household, especially those that have a good credit score who will qualify for the a minimal rates in the market. It’s also a fantastic choice to own drivers finding costly the latest cars; Navy Federal’s limit loan amount is actually $500,one hundred thousand, meaning you could push off inside a brand name-the fresh new car aided by the great features.

Kind of automobile financing offered

Navy Federal has the benefit of capital for new and you may made use of vehicle, and additionally car finance refinancing. The mortgage numbers given for brand new and you will put automobile could be the same, shedding anywhere between $250 and you can $five-hundred,100000. Refinancing features the very least amount borrowed out-of $5,100000, but Navy Federal will not indicate an optimum.

For brand new automobile orders and refinancing an alternate automobile, you could potentially prefer a phrase ranging from thirty-six and you can 96 months. Having car requests and you will refinancing an effective car or truck, you can choose from thirty-six and you may 72 weeks.

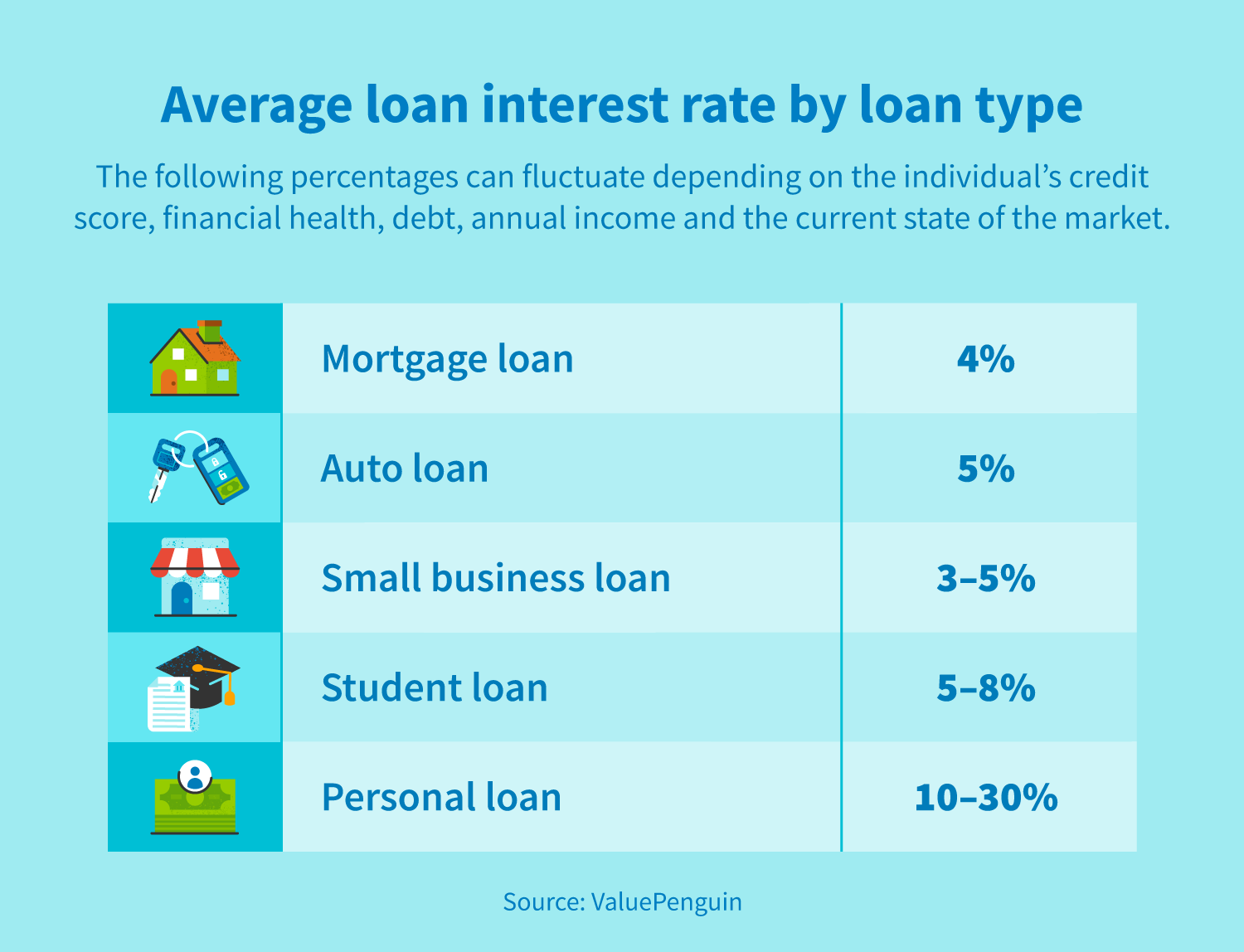

Rates of interest and you may terms and conditions

In place of other lenders, Navy Government does not promote an economy to have creating automated repayments. The interest rate will depend on your creditworthiness, finances and questioned loan name.

How to make an application for a loan that have Navy Federal

You could apply for a car loan that have Navy Government on line, through the Navy Federal software, over the phone or at the a branch. More often than not, you should found a choice within a few minutes off submitting your application.

- Their contact number and you will email (and people of your own co-applicant, if appropriate).

- Your homes, a job and you can income advice (and therefore of co-candidate, in the event that applicable).

If you have currently decided on a motor vehicle or if perhaps you will be refinancing, you’ll also have to supply the auto VIN matter, the latest membership state, the actual distance as well as the agent term.

After the approval, you will discovered the sign in the brand new mail, or you can figure it out during the an effective Navy Federal part.

Car loan standards

Navy Federal does not identify one borrowing from the bank or income conditions. However, just be sure to enroll in Navy Federal. You are able to be considered if you are in one of the pursuing the classes:

Customer care

Navy Government has a few some other customer care choices for their professionals. Member agencies appear 24/eight over the telephone at 888-842-6328, you can also get issues replied because of a real time speak element on the website. If you prefer within the-people communications, Navy Federal keeps 350 branches worldwide where you could chat deal with-to-deal with which have a support broker.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια