SAVANNAH, GA : Democratic presidential nominee Vice president Kamala Harris . [+] provides repaign rally during the Enmarket Arena inside Savannah, Georgia on the Thursday, . (Images by Demetrius Freeman/The latest Washington Post via Getty Photo)

In the event that presidential applicant Vice-president Kamala Harris launched their own intention which will make a want to render lower-earnings earliest-day homeowners $twenty-five,000 for an advance payment, critics wailed https://paydayloancolorado.net/todd-creek/. The big area is really worth given, but it is a theoretic risk and there’s thorough examples from how instance enough time-existing authorities software on some accounts been employed by.

The will to shop for a property is inspired by several guidelines. You to, people are informed, is to try to make wealth. That idea may seem voice, and other people carry out grow their websites worth this way, however, a home you own is close to usually where you live. It is really not property disposable at the whim because you next you want discover an alternative destination to live. It isn’t a pension membership otherwise emergency funds.

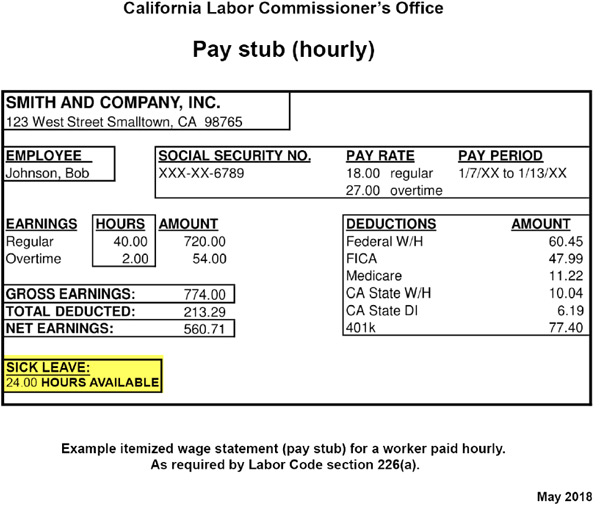

Although you’re eligible for a good 5% off financing, you still need $20,614 and additionally extreme settlement costs

The newest truest opinions have to do with not leasing. Someone try not to change you out on an impulse while they require to displace you which have a member of family or someone who might pay a great deal more. You will do pay focus on the financial, and you may look for develops in the fees or insurance coverage, although foot cost of your house will not increase annually because is the situation that have a rental. Louis, shows the entire year-over-year development in book away from top house.

After you’ve purchased property, the purchase price does not improve annually because the rent does. No matter if rent costs currently is actually lower than average family payments, fundamentally they’re not because they remain rising. Book expands was reducing, however in 2023, they were nearly 8% higher than inside the 2022. At that rates, using the code out-of 70 (split 70 of the rate from boost to determine exactly how a long time before some thing doubles inside worth), contained in this 9 many years their book doubles. Together with, every time you flow – anything else including the top-notch apartments being equivalent – there is a supplementary lease boost.

But not, homes are particularly ridiculously costly. We have found Census Agency study, once again via the St. Louis Fed, with the average U.S. house conversion rates.

Regarding 2nd quarter out-of 2024, that is $412,three hundred. Based on CoreLogic, the new 2021 federal average financial closing costs to possess an individual-family possessions and additionally import taxation was $6,905.

A first-day homeowner mode somebody who have not possessed a property into the around three years; an individual-moms and dad who previously merely owned a house with an old mate; a man whoever household did not have a permanent foundation; otherwise a beneficial displaced homemaker. The latter mode prior to now being a stay-at-home mommy or father who’s unemployed or unemployed, not any longer receives help from a spouse, and you can intentions to get a hold of work and commence a job.

Harris’s require $25,000 deposit assistance to basic-time reduced-income homebuyers possess set off an abundance of teeth-gnashing by people that think it is risky. They have been sure often drive upwards can cost you of the many house pricing.

When you look at the 2015, according to a federal Put aside Lender of the latest York analysis, universities greatly dependent on people just who benefited throughout the negative effects of develops from inside the government support hats raised tuition by the from the 65 cents for every even more dollars when you look at the school funding that Congress provided so you can children

not, new experts is actually ignoring a few things. Consumers regarding wealthier group commonly score guidance within the to invest in a primary house. Really does that not cause them concern? And, they might be acting as in the event the instance reduced-income first-day client programs have not been doing within government, condition, and you may local account for a long time. An excellent Forbes Mentor article out-of last year has many comprehensive postings of such programs.

If the experts haven’t tossed upwards the hand when you look at the stress more than ages, perhaps they have to recognize that down-payment direction has never proven a poor possibility, particularly while the mortgage brokers, not manufacturers, understand in which the consumers get their money. Brand new vendors do not know whether this will be a situation when they is walk the sales price and you will form brand new selling price was an even more delicate and you will state-of-the-art decision.

Μαβίλη 9, Άνω Πατήσια

Μαβίλη 9, Άνω Πατήσια